b&o tax rate washington state

Taxpayers are required to keep records for the most recent five year period. Constitution because it discriminates against out-of.

However you may be entitled to the Multiple Activities Tax Credit MATC.

. For products manufactured and sold in Washington a business owner is subject to both the Manufacturing BO Tax and the Wholesaling or Retailing BO Tax. Teee TTY er a e e Wagto Rea Serve ag 7. 823000 BO Tax 2021 JLARC TAX PREFERENCE REVIEW Review.

The state does not exempt marketplace facilitators from collecting and remitting sales tax in addition to the BO tax. Bremerton WA Sales Tax Rate. Washington State BO tax is based on the gross income from business activities.

Effective January 1 2020 an additional BO tax surcharge of 12 is imposed on specified financial institutionsdefined as financial institutions that are members of a consolidated financial institution group that reported on its consolidated financial statement for the previous calendar year annual net income of at least 1 billion. Effective April 1 2020 the BO tax will be imposed at two separate rates under the Service and Other Activities classification. Washingtons BO is an excise tax measured by the value of products gross proceeds of sales or gross income of a business with over 30 different classifications and associated tax rates ranging from 0138 percent to 15 percent.

Washington State is considered one of the better tax states in no small part because of its Small Business BO Tax Credit. The additional 3 is referred to as Workforce. ZIP--ZIP code is required but the 4 is optional.

Maintains the current 15 service and other activities BO tax rate on service-based gross receipts for. Kirkland WA Sales Tax Rate. Additional BO tax imposed on financial institutions.

Kennewick WA Sales Tax Rate. Reduced BO Rate for Printing and Publishing Newspapers Estimated 2021-23 beneficiary savings. For small a Washington corporation or LLC it is actually possible to end up paying no BO tax at all.

A prime contractor with a 100000 construction contract hires a subcontractor to perform a portion of the construction for 20000. If a city is not listed they have not reported to AWC that they have a local BO tax. 31 rows Bellingham WA Sales Tax Rate.

Its own tax rate. In addition staffing businesses must collect retail sales tax and remit the collected tax to the state on all income subject to the retailing classification of the BO tax unless a specific statutory exemption applies. B O tax rates When paying the B O tax to the Department of Revenue you declare your income in different categories.

The model was updated in 2007 2012 and 2019EHB 2005 passed in 2017 also established a task force of city and business representatives to recommend changes to the two-factor apportionment formula for service income under RCW. This proposal is effective July 1 2019. Washington state doesnt have income tax like most states but business owners do need to pay Business and Occupation BO tax and this is usually on a state and city level.

The gamblingcontests of chance BO tax rate would increase from 163 percent to 263 percent. For all other types of business activities mainly retail a business has nexus if its physically present in the state. Lacey WA Sales Tax Rate.

A Washington State superior court granted summary judgment for banking associations holding that the states additional 12 business and occupation BO tax imposed on certain financial institutions violates the Commerce Clause of the US. The service and other activities BO tax rate would increase from 15 percent to 25 percent. Everett WA Sales Tax Rate.

Kent WA Sales Tax Rate. The Small Business BO Tax Credit is applied on a sliding. Heres what the BO tax looks like for your business.

Marketplace facilitators such as Amazon typically collect sales tax at the retail sales rate which ranges from 7. Use this search tool to look up sales tax rates for any location in Washington. Advance computing businesses with worldwide revenues in excess of 100 billion will pay at a rate of.

Effective January 1 2020 specified business will pay BO tax at a rate of 18 on their taxable Washington revenue while select advance computing businesses with annual worldwide revenues between 25 billion and 100 billion will pay BO tax at a rate of 2. At least twenty-five percent of the persons total property total payroll or total receipts in this state. Beginning with business activities occurring on or after January 1 2020 HB 2158 will impose an increase to BO tax surcharges for the Services and Other Activities classification increased rate from 15 to 18 for any person primarily engaged within Washington in any combination of over 40 enumerated activities.

The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts. Legislation adopted in the 2003 session required the 45 cities with local BO taxes to adopt a city BO tax model ordinance. To calculate sales and use tax only.

Federal Way WA Sales Tax Rate. Each business owes the BO tax on its gross income. Edmonds WA Sales Tax Rate.

Year Interest Rate 2021 3 2020 4 2019 4 2018 3 2017 3. Increases the current 15 service and other activities BO tax rate on service-based gross receipts to 175 for all businesses with gross income of one million dollars or more except hospitals and large advanced computing businesses effective April 1 2020. Increased BO tax rates for certain aerospace tax classifications New 2020 legislation made several changes to how certain aerospace businesses are taxed and.

The nature of the activity determines the appropriate classification and tax rate. For wholesalers and apportionable activities Washington defines nexus for BO tax purposes in RCW 8204067 1. Multiple Activities Tax Credit MATC Small Business BO Tax Credit.

Businesses performing more than one activity may be subject to tax under one or more BO tax classifications. Small Business B. LEGISLATIVE AUDITORS RECOMMENDATION The preference reduces the BO tax rate for businesses that print or publish newspapers.

Local business occupation BO tax rates Effective January 1 2022 City Phone Manufacturing rate Retail rate Services rate Wholesale rate Threshold Tax rates are provided for cities with general local BO taxes as of the date listed. Most Washington businesses fall under the 15 gross receipts tax rate. PO BOX 47478 OLYMPIA WASHINGTON 98504-7478 360-705-6705 dorwagov For a atae or o ree doe a aerate ora v dorwagov or a 360-705-6705.

The reduced rate applies. If a taxpayer had taxable income of 1 million or more in the prior calendar year they will be subject to a 175 BO tax rate. Description This proposal would increase the business and occupation BO tax rates for most service businesses by 1 percentage point.

All books and records and business premises shall be open for examination during normal business hours by the Citys Tax License Division.

Why Our B O Tax Is Unfair R Seattlewa

A Quick Guide To Washington S Tax Code Economic Opportunity Institute Economic Opportunity Institute

Washington State Sales Use And B O Tax Workshop

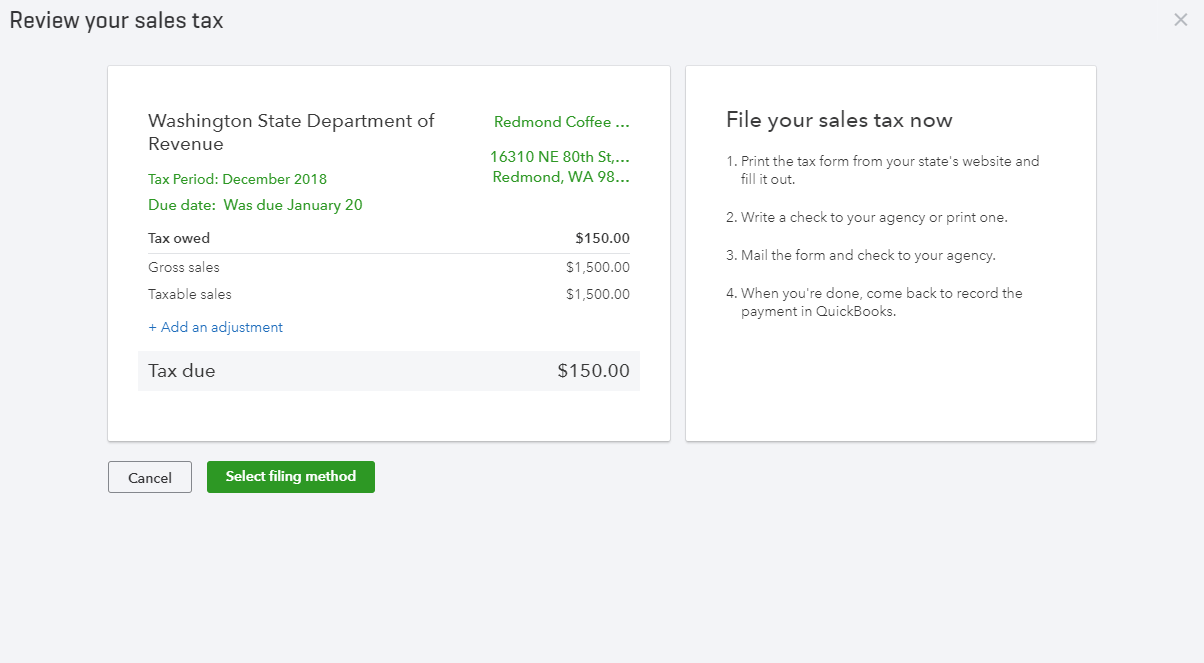

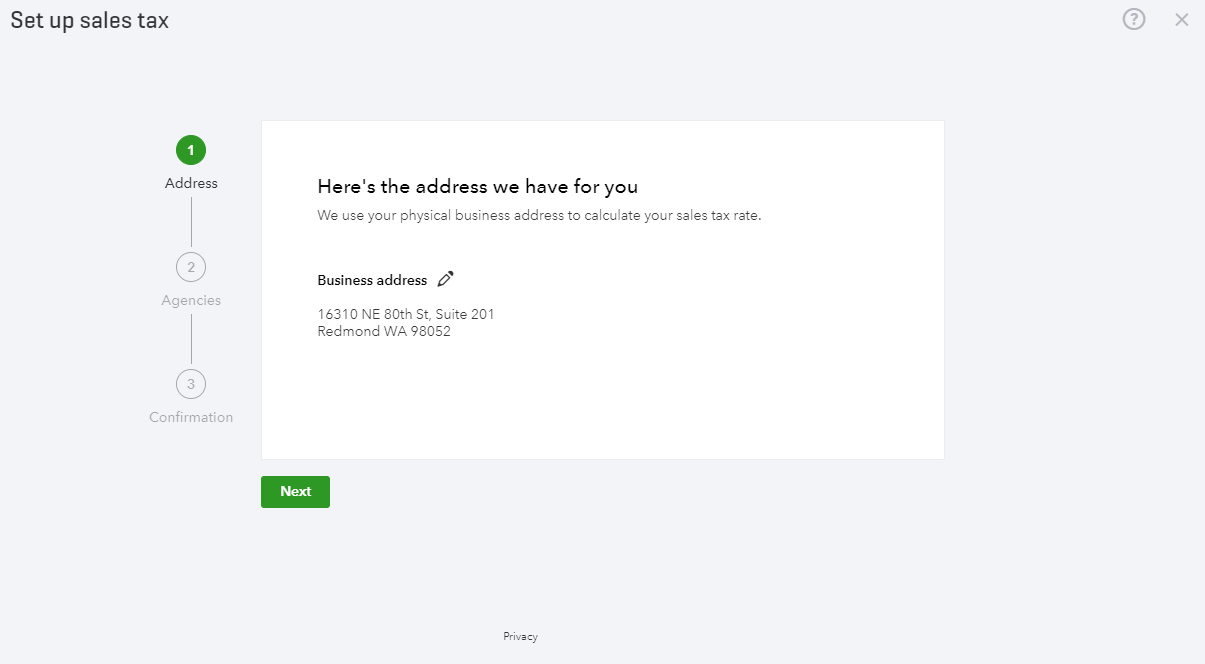

Record Wa Dor Excise And Sales Tax Payment In Quickbooks Online Gentle Frog Bookkeeping And Custom Training

How To Record Washington State Sales Tax In Quickbooks Online Evergreen Small Business

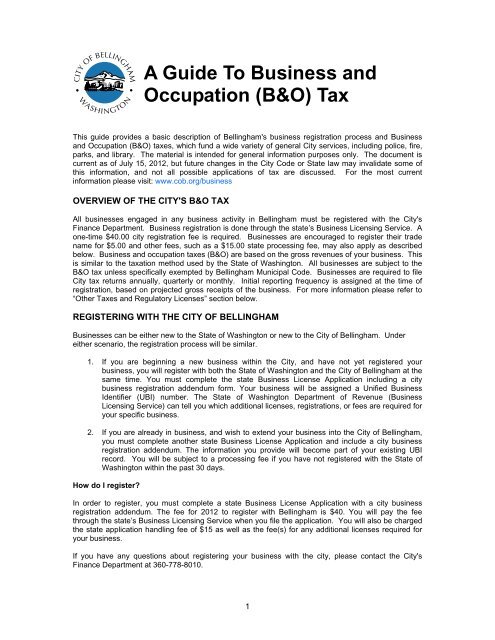

A Guide To Business And Occupation Tax City Of Bellingham Wa

Business And Occupation B O Tax Washington State And City Of Bellingham

How To Record Washington State Sales Tax In Quickbooks Online Evergreen Small Business

When Are Washington S Business Occupation B O Taxes Due 2021 Youtube

Zip Code Zones In The Usa Zip Code Map Coding Us Map

Taxes Federal Taxes Washington State Department Of Agriculture

Am I Taxed Too Much Understanding The Impacts Of Fiscal Policy Washington State Wire